Where to Buy Copper

Track the live copper price and find trusted online dealers. Browse copper bullion products from reputable sources.

Shop Copper Online

Why Buy Copper?

Copper — known as "Dr. Copper" for its ability to predict economic trends — is increasingly popular among bullion collectors. While copper's low price per pound means physical premiums are proportionally much higher than gold or silver, copper bullion is an affordable way to hold tangible metal.

- Economic bellwether — Copper prices are considered a leading indicator of economic health due to its widespread industrial use

- Affordable entry — Copper rounds and bars cost a fraction of gold or silver, making them accessible gifts and starter pieces

- Industrial demand — Essential for construction, electronics, EVs, solar panels, and power grid infrastructure

- Green energy exposure — EVs use 3–4x more copper than traditional vehicles. Renewable energy infrastructure is copper-intensive

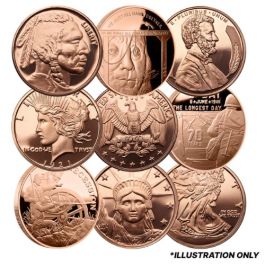

Copper Rounds vs. Bars

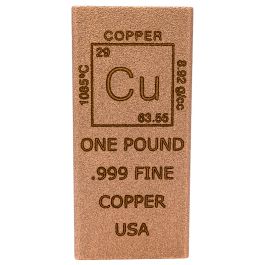

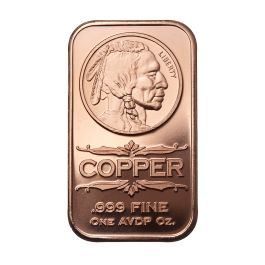

Physical copper bullion comes in two main forms. Both carry high premiums relative to spot price because manufacturing costs are significant compared to copper's low commodity price.

- Copper rounds — 1 oz rounds are the most popular format. Available in hundreds of designs from private mints. Great for collecting and gifts

- Copper bars — Available in 1 lb, 5 oz, 10 oz, and larger sizes. Lower per-ounce premiums than rounds

- Copper bullets and shapes — Novelty items shaped like bullets, cubes, or other objects. Fun collectibles but carry the highest premiums

Understanding Copper Premiums

Physical copper premiums work differently than gold or silver. Because copper trades at just a few dollars per pound, the manufacturing cost of a 1 oz round or bar can exceed the metal value many times over.

- Spot price reality — At ~$4/lb, one troy ounce of copper is worth roughly $0.29 at spot. A 1 oz copper round typically sells for $1–$3

- Not a pure investment — The premium-to-spot ratio makes physical copper a poor vehicle for speculating on copper prices. It's better viewed as a collectible or novelty

- Bulk savings — Larger bars (1 lb, 5 lb, 10 lb) offer better value per ounce of actual copper

- Investment alternatives — For pure copper price exposure, ETFs like CPER or copper futures are more cost-effective

Copper in the Green Energy Transition

Copper is a critical metal for the global shift to renewable energy and electric transportation. This long-term demand trend is one reason investors are interested in copper exposure.

- Electric vehicles — A typical EV uses 130–180 lbs of copper, compared to 50 lbs in a conventional car

- Solar and wind — Solar panels and wind turbines require significant copper wiring and components

- Power grids — Upgrading aging electrical grids worldwide requires massive amounts of copper

- Supply challenges — New copper mines take 10–15 years to develop, creating potential long-term supply constraints