Where to Buy Gold

Track the live gold spot price and browse trusted online dealers. Compare gold coins, bars, and rounds from reputable sources.

Shop Gold Online

Understanding Gold Premiums

When you buy physical gold, you pay the spot price (the live market price shown above) plus a dealer premium. Premiums cover minting, distribution, and dealer margin. They vary by product type — bars carry the lowest premiums, government-minted coins carry the highest.

- Gold bars — Typically 2–5% over spot. Lowest cost per ounce, ideal for larger purchases

- Gold rounds — 3–6% over spot. Private-mint alternatives to sovereign coins

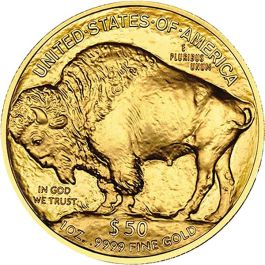

- Gold coins — 4–8% over spot. American Eagles, Maple Leafs, and Krugerrands carry higher premiums but are the most liquid and widely recognized

- Fractional gold — 8–15% over spot. 1/10 oz and 1/4 oz coins let you start small, but premiums are higher per ounce

Gold Coins vs. Gold Bars

The choice between coins and bars depends on your goals. Gold coins are government-minted with legal tender status, making them easier to sell and more widely recognized worldwide. Gold bars from LBMA-accredited refiners like PAMP Suisse, Valcambi, and the Royal Canadian Mint offer the lowest premiums per ounce.

- Choose coins if you want maximum liquidity, easy resale, and worldwide recognition

- Choose bars if you want the lowest cost per ounce and are buying larger quantities

- Mix both — Many experienced stackers hold a core position in bars for cost efficiency and keep coins for portability and easy divisibility

What to Look for When Buying Gold

Whether you buy online or from a local dealer, here's what matters most:

- Purity — Investment-grade gold is .999 or .9999 fine (24 karat). American Gold Eagles are .9167 fine (22k) but contain exactly 1 troy ounce of pure gold

- Weight — Standard sizes are 1 oz, 1/2 oz, 1/4 oz, 1/10 oz (coins) and 1 oz, 10 oz, 1 kilo (bars). Larger sizes = lower premiums per ounce

- Mint reputation — Stick with sovereign mints (US Mint, Royal Canadian Mint, Perth Mint) or LBMA-accredited refiners

- Transparent pricing — Good dealers show the spot price and premium separately. Avoid dealers who won't break down the cost

Storage and Insurance

Once you own physical gold, you need to keep it safe. Home storage (a quality safe bolted to the floor) works for smaller holdings, but larger positions benefit from professional vault storage.

- Home safe — Affordable and private, but check your homeowner's insurance for precious metals coverage limits

- Bank safe deposit box — Secure but not insured by the bank and inaccessible during bank holidays

- Third-party vault — Fully insured, audited storage from services like SD Bullion's vault program. Annual fees are typically 0.5% of value

- Insurance — Standard homeowner's policies often cap precious metals coverage at $1,000–$2,500. Consider a separate rider or floater policy

Why Buy from an Online Dealer?

Online precious metals dealers consistently offer lower premiums than local coin shops because they operate at scale with lower overhead. You also get access to a much wider selection of products, real-time pricing tied to spot, and insured shipping to your door.

- Lower premiums — Online dealers typically beat local shops by 1–3% on premiums

- Wider selection — Browse hundreds of products from major mints and refiners in one place

- Price transparency — See exactly how much you're paying over spot before you buy

- Insured shipping — Reputable dealers ship via insured, tracked carriers with discreet packaging